Living In a Tax Friendly State Like Florida or Texas Can Save You Tens of Thousands

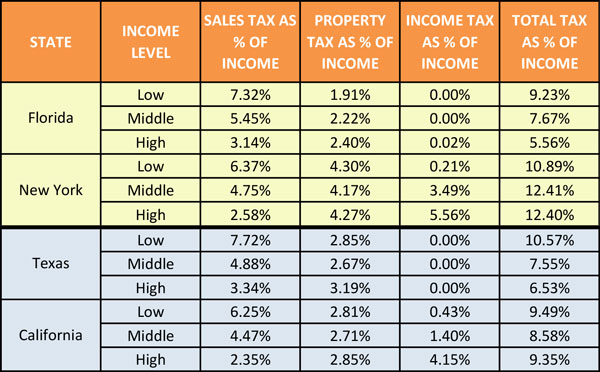

When considering the best place to live, most people recognize how important weather, housing costs, quality of life, job opportunities, income, and climate are, but very few people know just how much they will save in taxes if they move to the right state. Whether you’re an aging baby-boomer on the cusp of retiring, or a professional making a career change, you should be aware of just how much in taxes you can save by choosing the right state. Consider the following table based on information provided by The Institute on Taxation and Economic Policy, (ITEP), on the share of a person’s income that will be contributed to State and local, Sales, Property and Income Taxes:

Both Texas and Florida Have some of the most desirable state tax environments. Applying the percentages provided by (ITEP), to an individual making $200,000 per year, it’s easy to determine just how beneficial the state and local tax savings will be if you move.

A person moving from California that is paying $18,700 in state and local taxes, that moves to Texas will only pay $13,060. That’s a $5,600 savings excluding the lower cost associated with housing and the cost of living.

A person moving from New York that is contributing $24,800 to state and local taxes, will only contribute $12,200 to state and local taxes. That’s a whopping $12,600 savings in state and local taxes!

For someone that is a high-income earner, the difference in state and local taxes is in the tens of thousands. For someone that earns less, the difference can be much worse. Although the dollar amount may not be as large, the percentage paid for state and local taxes is much higher. You can use the chart above to calculate the amount that can be saved by multiplying your annual income by the percentage of taxes paid where you’re presently living, then comparing that number to the dollar amount you will be paying in the state you are thinking about moving to.