Buyer Considerations – Why Renting is a Recipe for Financial Disaster

What is the difference between buying a home and renting one?

Aside from the emotional benefits, the single-most important consideration should be the long-term financial benefit of home ownership. When a person decides to rent, the money they pay for housing is actually paying off an investor’s mortgage. It’s what investors call, “using other people’s money.” The problem with this strategy is that long-term, a renter has nothing to show for the money they’ve spent monthly. If you continue to rent, will you ever be financially secure enough to retire?

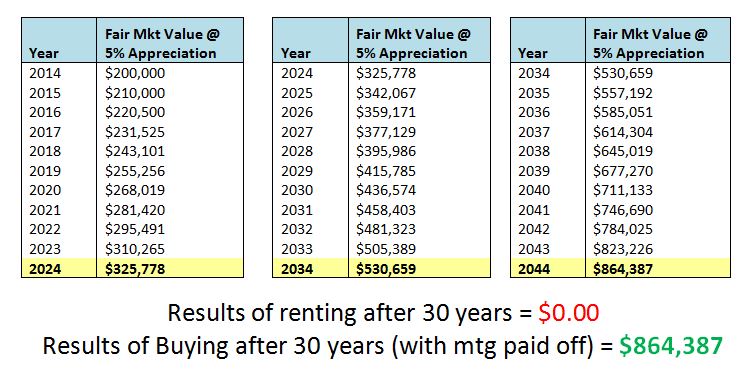

On the other hand, when a home is purchased, in addition to the emotional benefits and tax savings, (mortgages can be deducted from taxes to provide a tax refund) the profit from long-term appreciation is usually quite substantial. Review the following appreciation charts that consider the purchase of an average home at $200,000. If a person were to rent for 30 years, they have nothing to show for the monthly payments they’ve made. The same person purchasing a home will have their net worth increase by $125,778 over 10 years, $330,659 over 20 years, or $664,387 over 30 years. That’s not too bad given the fact that most people save next to nothing. The critical question you must ask yourself before deciding to rent or buy is:

“Do I want to have hundreds of thousands towards retirement by buying, or do I want to rent and pay for someone else to have hundreds of thousands in additional net worth?”