2015 Seller Considerations – Tick, Tock, Goes the Interest Rate Clock

Strong Market Activity and continued housing appreciation have emboldened homeowners interested in selling. Why should any home seller think that things won’t just continue to get better? The answer is simple. The primary reason for the housing recovery has been the government’s bond buying and low interest rate policies. Bond buying ceased last year and Interest rates are expected to increase in the near future. This could have a serious impact on the recovery of the housing industry.

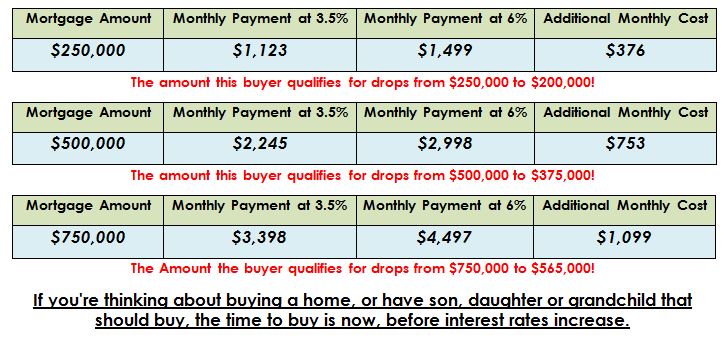

If rates increase sooner than later, the additional cost to buyers would likely have a serious effect on the ability to qualify for a mortgage. As an example, if mortgage rates were to rise to 6% from the recent 3.5%, monthly payment on a 30 year mortgage would increase by a third. This would mean that the same buyer would have to purchase a home worth 33% less to qualify. As interest rates rise, the impact on home sellers is immediate. More expensive mortgage payments equal fewer buyers able to quality, ultimately leading to lower prices. Home sellers must been keenly aware of the impact of rising interest rates. Consider the examples below: